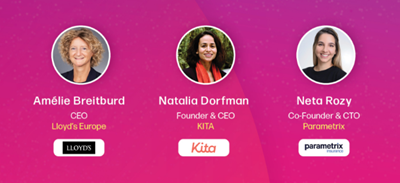

On 8 March 2023, Lloyd’s Europe CEO Amélie Breitburd participated in a Webinar hosted by ITC DIA Europe entitled “Insurance, Innovation, Disruption: Closing Europe’s Cyber and Climate Protection Gaps”. Amélie Breitburd was joined by Lloyd’s Lab Alumni Natalia Dorfman, CEO and Co-Founder at Kita, and Neta Rozy, CTO and Co-Founder at Parametrix, to discuss the landscape of the climate and cyber spaces and how to address the protection gaps within. The following is a summary of the key takeaways from the session, written by Merlin Beyts of ITC DIA Europe.

Amélie Breitburd

Lloyd's Europe CEO

The Cyber Landscape

Why are there such big protection gaps in the European Cyber market?

Amélie Breitburd (CEO, Lloyd’s Europe): Part of it is because probably in Europe lots of the people believe that if something bad happens, then governments will step in. We saw that with COVID. What we want is for people to be more aware of cyber risks. Many SMEs might think that because they’re not “big fish” that they’re safe and that nothing’s going to happen to them. But while we can see that the hackers started with the large corporates, they are now looking at SMEs as it looks like a smaller price. But as there’s a large volume, at least some will have weaknesses. And I think this is where we have, as a platform, a role to educate people so that they understand what cyber risk is and why they are going to have to make sure that they are protected.

Neta Rozy (CTO and Co-Founder, Parametrix): Parametric insurance is a new type of insurance, as is cyber relative to insurance. So cyber insurance is also relatively new and parametric insurance is difficult to create. There’s a lot of parameters that have to be in place. It’s a very technical insurance and it’s something that involves a lot of technology and a lot of mitigation – and these things take time to move. The US market is almost always a quicker market to adapt and to adopt new products and most companies will focus actually on the US market before they focus on the European market. But I think the European market usually isn’t too far behind the US!

What can insurers do to better mitigate the risk of cyber threats?

Neta Rozy (CTO and Co-Founder, Parametrix): Well, look at cloud providers like companies like Amazon, Microsoft, Google, they’re some of the most secure companies in the world. They really employ some of the brightest minds of today and so from a technology perspective they continuously improve and continuously secure their products and their companies. With that being said, downtime is still inevitable. There’s so much competition in the market trying to bring out new products as quickly as possible. So there are going to be software mistakes and that’s where both cyber and downtime have an opening. Cyber-attacks are actually never the root cause of cloud downtime. Rather, it’s generally human error or infrastructure based.

"As a platform, we have a role to educate people so that they understand what cyber risk is and why they are going to have to make sure that they are protected."Amélie Breitburd, Lloyd's Europe CEO

The climate landscape

How can the insurance industry play its part in adressing climate change?

.jpg)

Natalia Dorfman (CEO and Co-Founder, Kita): Well our focus is using insurance to enable more upfront financing to help carbon removal solutions scale. Our focus is on assisting companies that are engaged in the critical task of extracting carbon dioxide from the atmosphere and securely storing it underground. We achieve this by de-risking financial transactions associated with their projects. By doing so, we believe that we are making a valuable contribution towards the global fight against climate change. We have too much carbon dioxide in the air and if we have solutions that can remove it and we can help scale those solutions by de-risking them, I think that’s a very important thing to do.

Why should insurers approach different markets with different solutions?

Amélie Breitburd (CEO, Lloyd’s Europe): This is where we wanted to have something which would better match those needs. So carbon is obviously one area. If you think about the floods that we had in Europe 18 months ago, they were in Belgium, the Netherlands and Germany and only 30% of the people were insured. This is where the focus should be for Europe because if you think about the Netherlands or Belgium, the fact that you could have floods, not just from the volume of rain, but the bigger problem, in terms of rising sea levels. Some would say, well, it’s the same in Florida. It just so happens that the sea is not exactly the same. The waves are not the same. The time that we have to solve that issue is not the same as well.

Watch the webinar

Watch the full webinar, “Insurance, Innovation, Disruption: Closing Europe’s Cyber and Climate Protection Gaps” hosted by ITC DIA Europe.